The Federal Reserve Begins A 2-Day Meeting Today

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee (FOMC) begins a 2-day meeting today, its last of 8 scheduled meetings this year.

The Federal Open Market Committee is a 12-person subcommittee within the Federal Reserve. It’s the group which votes upon U.S. monetary policy.

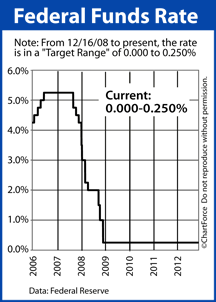

The monetary policy action for which the FOMC is most well-known is its setting of the Fed Funds Funds. The Fed Funds Rate is the interest rate at which banks borrow money from each other overnight.

Since late-2008, the Fed Funds Rate has been near zero percent.

Prime Rate, a business and consumer interest rate used in lines of credit and credit card rates, is based on the Fed Funds Rate. Prime Rate has been similarly unchanged since 2008.

One rate which the Federal Reserve does not set is the 30-year fixed rate mortgage (FRM) rate.

Like all other mortgage rates, the 30-year FRM is based on the market value of mortgage-backed bonds; securities bought and sold by investors.

There is no correlation between the Federal Reserve’s Fed Funds Rate and the everyday homeowner’s 30-year fixed rate mortgage rate. Some months, the two rates converge. Other months, they diverge. Since 2000, they’ve been separated by as many as 5.29 percentage points.

They’ve been as close as 0.52 percentage points.

However, although the Federal Reserve does not set U.S. mortgage rates, that doesn’t mean that it can’t influence them. The Fed’s post-meeting press release has been known to make mortgage rates get volatile.

If, in its post-meeting press release, the Fed notes that the U.S. economy is slowing and that new economic stimulus is warranted, mortgage rates will likely fall throughout Minnesota. This is because additional Fed stimulus would likely lend support to U.S. mortgage markets which would, in turn, boost demand for mortgage-backed bonds.

Conversely, if the Fed acknowledges stronger-than-expected growth in the U.S. economy and no need for new stimulus, mortgage rates are expected to rise.

Either way, mortgage rates will change Wednesday upon the FOMC’s adjournment — we just don’t know in which direction. Rate shoppers may see fluctuations of as much as 0.250 percent.

The FOMC adjourns at 12:30 PM ET.

Categories

- Around The Home

- Awards

- Bankruptcy History

- Budget

- Chapter 7 Bankruptcy

- Construction Loan

- Credit

- Credit Scoring

- Environmental Awareness

- Escrow Tips

- Fair Housing

- Federal Reserve

- FHFA

- Financial Crisis

- Financial Fraud

- Financial Reports

- Foreclosure

- Holiday Tips

- Holidays

- Home Building Tips

- Home Buyer Tips

- Home Buying Tips

- Home Care

- Home Care Tips

- Home Decorating

- Home Financing Tips

- Home Maintenance

- Home Mortgage

- Home Mortgage

- Home Mortgage Tips

- Home Mortgages

- Home Seller Tips

- Home Selling Tips

- Home Tips

- Home Values

- Home Values

- Homebuyer Tips

- Homeowner Tips

- Housing Analysis

- Housing Market

- Investment Properties

- Market Outlook

- Mortagage Tips

- Mortgage

- Mortgage Application

- Mortgage Guidelines

- Mortgage Rates

- Mortgage Tips

- mortgage-rates-whats-ahead-september-17-2012

- Organization Tips

- Personal Development

- Personal Finance

- Rankings

- Real Estate

- Real Estate Definitions

- Real Estate Tips

- Real Estate Trends

- Selling Your Home

- Student Loans

- Tax Debts

- Taxes

- The Economy

- Travel

- Uncategorized