Home Builder Confidence Moves To 6-Year High

As home prices rise, so does home builder confidence.

As home prices rise, so does home builder confidence.

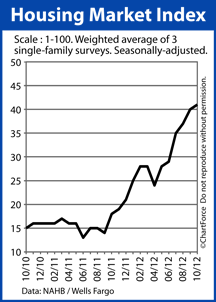

Tuesday, the National Association of Homebuilders reported its monthly Housing Market Index (HMI) at 41, a one-tick improvement from September and the highest HMI value since June 2006 — a span of 77 months.

The Housing Market Index is a homebuilder confidence indicator. When it reads 50 or better, the HMI suggests favorable conditions for home builders nationwide. Readings below 50 suggest unfavorable conditions for builders.

The HMI has not crossed 50 since April 2006 but the index has been making a run since last year, nearly tripling since the 14 reading of last year’s September.

In addition, builder confidence has climbed for six straight months.

For Minneapolis buyers of new construction, the Housing Market Index may help to set market expectations for the rest of 2012, and into early-2013. This is because the NAHB Housing Market Index is constructed as a composite survey, measuring builder sentiment in three specific areas — current home sales, future home sales, and buyer foot traffic.

What’s good for builders, though, may not be good for buyers.

When builders expect business to improve, they may be less willing to make concessions on price or product, holding home prices high and removing seasonal sales incentives.

This month, home builders are seeing strength in each of the three surveyed areas :

- Current Single-Family Sales : 42 (Unchanged from September)

- Projected Single-Family Sales : 51 (Unchanged from September)

- Buyer Foot Traffic : 35 (+5 from September)

All three values are at multi-year highs but it’s the level of foot traffic that may concern today’s home buyers. Builders report foot traffic through model units to be at the highest rate since mid-last decade. This, combined with a shrinking supply of homes for sale, has contributed to a rise in new home sale prices and suggests even higher home prices in 2013.

Like most of the U.S. housing market, new construction appears to have bottomed in October 2011. One year later, the market looks stronger.

Categories

- Around The Home

- Awards

- Bankruptcy History

- Budget

- Chapter 7 Bankruptcy

- Construction Loan

- Credit

- Credit Scoring

- Environmental Awareness

- Escrow Tips

- Fair Housing

- Federal Reserve

- FHFA

- Financial Crisis

- Financial Fraud

- Financial Reports

- Foreclosure

- Holiday Tips

- Holidays

- Home Building Tips

- Home Buyer Tips

- Home Buying Tips

- Home Care

- Home Care Tips

- Home Decorating

- Home Financing Tips

- Home Maintenance

- Home Mortgage

- Home Mortgage

- Home Mortgage Tips

- Home Mortgages

- Home Seller Tips

- Home Selling Tips

- Home Tips

- Home Values

- Home Values

- Homebuyer Tips

- Homeowner Tips

- Housing Analysis

- Housing Market

- Investment Properties

- Market Outlook

- Mortagage Tips

- Mortgage

- Mortgage Application

- Mortgage Guidelines

- Mortgage Rates

- Mortgage Tips

- mortgage-rates-whats-ahead-september-17-2012

- Organization Tips

- Personal Development

- Personal Finance

- Rankings

- Real Estate

- Real Estate Definitions

- Real Estate Tips

- Real Estate Trends

- Selling Your Home

- Student Loans

- Tax Debts

- Taxes

- The Economy

- Travel

- Uncategorized