New Home Supply Remains Firmly In “Seller’s Market” Territory

The market for new construction homes remains strong nationwide.

The market for new construction homes remains strong nationwide.

According to the U.S. Census Bureau, the number of new homes sold slipped 0.3 percent in August 2012 to a seasonally-adjusted, annualized 373,000 units sold — just 1,000 units less than July 2012 and the second-highest reading since April 2010.

April 2010 was the last month of that year’s tax credit which granted home buyers up to $8,000 off of their federal tax bill.

As compared to one year ago, sales of new homes are higher by 28%.

Furthermore, during the same time frame, the median sale price of a new home moved higher by 17 percent. The rising prices, in part, are the result of a shrinking national new home inventory.

When August ended, there were just 141,000 homes for sale nationwide — a 12% drop from the year prior. This suggests that home builders have stopped building without buyers; that some lessons were learned in last decade’s homebuilding frenzy.

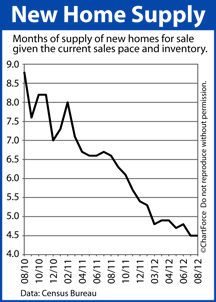

At today’s pace of home sales, the entire stock of new homes nationwide would sell out in 4.5 months. As a comparison point, in January 2009, the new home supply reached 12.1 months.

With home supply below 6.0 months, analysts say, it signifies a “seller’s market” and home supplies have not been north of 6.0 months since October 2011. And, based on recent homebuilder confidence surveys, supply doesn’t appear headed back over 6.0 months anytime soon.

Builders in Illinois and nationwide report that prospective buyer foot traffic is at its highest point in 6 years. Low mortgage rates and affordable housing choices have held demand for new homes strong. Rising rents contribute, too.

For today’s home buyers of new construction, then, shrinking supply amid rising demand portends higher home prices into 2013 and beyond. If you’re a buyer of new construction, therefore, think about moving up your time frame.

The best deals left in housing may be the ones you grab while the calendar still reads 2012. By January, low prices may be gone, and low rates may be, too.

Categories

- Around The Home

- Awards

- Bankruptcy History

- Budget

- Chapter 7 Bankruptcy

- Construction Loan

- Credit

- Credit Scoring

- Environmental Awareness

- Escrow Tips

- Fair Housing

- Federal Reserve

- FHFA

- Financial Crisis

- Financial Fraud

- Financial Reports

- Foreclosure

- Holiday Tips

- Holidays

- Home Building Tips

- Home Buyer Tips

- Home Buying Tips

- Home Care

- Home Care Tips

- Home Decorating

- Home Financing Tips

- Home Maintenance

- Home Mortgage

- Home Mortgage

- Home Mortgage Tips

- Home Mortgages

- Home Seller Tips

- Home Selling Tips

- Home Tips

- Home Values

- Home Values

- Homebuyer Tips

- Homeowner Tips

- Housing Analysis

- Housing Market

- Investment Properties

- Market Outlook

- Mortagage Tips

- Mortgage

- Mortgage Application

- Mortgage Guidelines

- Mortgage Rates

- Mortgage Tips

- mortgage-rates-whats-ahead-september-17-2012

- Organization Tips

- Personal Development

- Personal Finance

- Rankings

- Real Estate

- Real Estate Definitions

- Real Estate Tips

- Real Estate Trends

- Selling Your Home

- Student Loans

- Tax Debts

- Taxes

- The Economy

- Travel

- Uncategorized