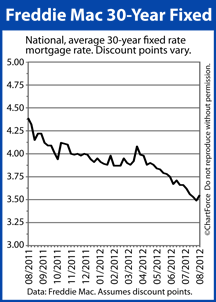

Freddie Mac 30-Year Fixed Rate Mortgage Rates Rises To 3.55%

Mortgage rates couldn’t fall forever, it seems.

Mortgage rates couldn’t fall forever, it seems.

This week, for the first time since mid-June, the 30-year fixed rate mortgage rate climbed on a week-over-week basis, moving 6 basis points to 3.55%, on average, nationwide.

According to Freddie Mac, 3.55 percent is the highest average rate at which the benchmark product has been offered in close to 4 weeks.

The Freddie Mac published mortgage rate is available for prime borrowers willing to pay a full set of closing costs plus an accompanying 0.7 discount points.

Discount points are a one-time, upfront mortgage loan fee to be paid at closing where 1 discount point is equal to one percent of your loan size. In this way, a Minneapolis home buyer who pays one discount point at closing will be responsible for an additional $1,000 in closing costs per $100,000 borrowed.

However, although Freddie Mac says that the average mortgage rate is 3.55%, not everyone who applies for a conforming mortgage will get access to that rate. This is because Freddie Mac’s published rates are the ones offered to “prime” borrowers, the definition of which often includes :

- Top-rated credit scores, typically 740 or higher

- Verifiable income using two year’s of tax returns

- Home equity of at least 25%

Borrowers not meeting the above criteria should expect slightly higher mortgage rates and/or discount points. In some cases, such as when an applicant’s credit score is below 680, mortgage rates may be higher by as much as 0.500%.

Although mortgage rates are up this week, though, the impact on home affordability is muted. Mortgage payments rose just $3 per month per $100,000 borrowed this week as compared to last week. 3.55% remains the third-lowest Freddie Mac rate of all-time.

Mortgage rates remain unpredictable and there’s no guarantee for low rates to last forever — much less through August. If today’s mortgage rates meet your needs, therefore, consider locking something in.

Categories

- Around The Home

- Awards

- Bankruptcy History

- Budget

- Chapter 7 Bankruptcy

- Construction Loan

- Credit

- Credit Scoring

- Environmental Awareness

- Escrow Tips

- Fair Housing

- Federal Reserve

- FHFA

- Financial Crisis

- Financial Fraud

- Financial Reports

- Foreclosure

- Holiday Tips

- Holidays

- Home Building Tips

- Home Buyer Tips

- Home Buying Tips

- Home Care

- Home Care Tips

- Home Decorating

- Home Financing Tips

- Home Maintenance

- Home Mortgage

- Home Mortgage

- Home Mortgage Tips

- Home Mortgages

- Home Seller Tips

- Home Selling Tips

- Home Tips

- Home Values

- Home Values

- Homebuyer Tips

- Homeowner Tips

- Housing Analysis

- Housing Market

- Investment Properties

- Market Outlook

- Mortagage Tips

- Mortgage

- Mortgage Application

- Mortgage Guidelines

- Mortgage Rates

- Mortgage Tips

- mortgage-rates-whats-ahead-september-17-2012

- Organization Tips

- Personal Development

- Personal Finance

- Rankings

- Real Estate

- Real Estate Definitions

- Real Estate Tips

- Real Estate Trends

- Selling Your Home

- Student Loans

- Tax Debts

- Taxes

- The Economy

- Travel

- Uncategorized