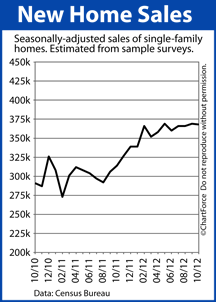

New Home Sales Remain Elevated Into Q4 2012

Sales of newly-built homes took a small step lower in October, but remain strong.

Sales of newly-built homes took a small step lower in October, but remain strong.

According to the Commerce Department, New Home Sales slipped 1,000 units last month, falling to 368,000 units on a seasonally-adjusted, annualized basis.

The final reading fell short of Wall Street expectations, and the government revised downward its initial findings from August and September by 2,000 units and 20,000 units, respectively.

A “new” home is a home that is considered new construction.

Furthermore, the number of new homes for sale nationwide ticked higher to 147,000 — the highest reading in 9 months.

However, in taking a broader look at October’s New Home Sales report, we see obvious strengths. For example, although home sales slipped last month, it remains the third-highest tally since the April 2010 expiration of the federal home buyer tax credit.

The highest reading? Last month’s 369,000.

In addition, the national new home inventory has dropped, off 8% from last year. Fewer homes for sales has been a driving force behind rising home prices. As compared to one year ago, the median new home price is up nearly six percent. More demand for buyers is a factor, too.

At the current sales pace, the complete U.S. inventory of new homes for sale would “sell out” in 4.8 months. This is a noteworthy data point because, as analysts point out, a 6.0-month supply of homes marks a market in balance.

Today’s new homes market, therefore, is a seller’s market; one in which home builders may be gaining pricing power and negotiation leverage over buyers. It’s one reason why home builder confidence has climbed to a 5-year high.

For buyers of new construction, then, in Minneapolis and nationwide, 2013 is a critical year. Home prices may rise and mortgage rates may, too. And, along the way, it may get tougher to get a “great deal” on new construction.

If you’re planning to buy, therefore, consider moving up your time frame. After October’s small step backward, the time to buy a newly-built home may be now.

Categories

- Around The Home

- Awards

- Bankruptcy History

- Budget

- Chapter 7 Bankruptcy

- Construction Loan

- Credit

- Credit Scoring

- Environmental Awareness

- Escrow Tips

- Fair Housing

- Federal Reserve

- FHFA

- Financial Crisis

- Financial Fraud

- Financial Reports

- Foreclosure

- Holiday Tips

- Holidays

- Home Building Tips

- Home Buyer Tips

- Home Buying Tips

- Home Care

- Home Care Tips

- Home Decorating

- Home Financing Tips

- Home Maintenance

- Home Mortgage

- Home Mortgage

- Home Mortgage Tips

- Home Mortgages

- Home Seller Tips

- Home Selling Tips

- Home Tips

- Home Values

- Home Values

- Homebuyer Tips

- Homeowner Tips

- Housing Analysis

- Housing Market

- Investment Properties

- Market Outlook

- Mortagage Tips

- Mortgage

- Mortgage Application

- Mortgage Guidelines

- Mortgage Rates

- Mortgage Tips

- mortgage-rates-whats-ahead-september-17-2012

- Organization Tips

- Personal Development

- Personal Finance

- Rankings

- Real Estate

- Real Estate Definitions

- Real Estate Tips

- Real Estate Trends

- Selling Your Home

- Student Loans

- Tax Debts

- Taxes

- The Economy

- Travel

- Uncategorized